Banking on blockchain: How TradFi and Fintech are racing to embrace crypto

Author: Vinny Mullin

The financial sector is at the beginning of a crypto revolution. Blockchain technologies have moved from niche to mainstream, with a global $2.7 trillion crypto market cap* and $5.28 trillion in stablecoin transactions settled in 2024.** Leading financial services companies are taking notice.

BlackRock CEO Larry Fink declared, “The next generation for markets… will be tokenization of securities,” while Charles Schwab CEO Rick Wurster hinted at entering direct crypto trading. Even JPMorgan’s Jamie Dimon, a known skeptic, admitted, “We use blockchain technology today for certain things… It’s a very efficient way to transfer information or assets securely.”

The signals are clear: top financial services teams are already building crypto solutions.

This blog explores why now is the time for financial institutions, fintechs, and neobanks to embrace crypto, offers specific strategies to pursue, and explains why Alchemy is the trusted, enterprise-grade partner who can help.

Top institutions are moving into crypto

Top institutions are already executing on crypto strategies, such as:

BlackRock launched a tokenized fund that recently crossed $1 billion in AUM, signaling strong demand for real-world asset (RWA) tokenization. The fund also announced diversification into Solana.

JPMorgan’s Onyx processes billions of dollars daily using JPM Coin for corporate settlements.

Charles Schwab saw a 400% increase in crypto-related traffic in 2024 and is preparing to offer direct crypto trading once regulations permit.

Fintechs and neobanks are moving even faster:

Robinhood Wallet attracted over 1 million users.

Revolut’s Crypto Hub saw a fivefold increase in crypto activity after integrating crypto features.

PayPal’s PYUSD stablecoin processes billions in volume, generating over $200 million in annual revenue.

These moves are driven by compelling factors:

Customer demand: 73% of institutional investors now hold multiple altcoin positions, and interest from retail users continues to grow, according to Coinbase.

New revenue streams: Trading, staking, custody fees, and stablecoin reserves represent billions in potential revenue.

Operational efficiency: Crypto rails enable 24/7 global payments, instant settlements, and programmable money, cutting costs and reducing friction.

Future-proofing: Tokenization of traditional assets and the growth of DeFi will reshape capital markets. Early movers will capture this opportunity.

From limitations to innovation: Why crypto matters

Traditional financial systems are constrained by inefficiencies that crypto solves:

Limited market hours vs. 24/7 markets: Crypto and tokenized assets trade continuously, offering real-time liquidity.

Cross-border friction vs. instant global transfers: Stablecoins facilitate near-instant cross-border payments without intermediaries.

Centralized control vs. user empowerment: Self-custodial wallets and decentralized protocols give users greater control over their assets.

Slow settlement vs. near-instant finality: Tokenized assets settle in minutes, reducing counterparty risk and unlocking capital efficiency.

These improvements create a step-function increase in global financial efficiency that can drive multi-trillion-dollar growth and greater financial inclusion.

Where do we see opportunity in crypto?

We’ve spent years working with early movers adopting crypto solutions, and we’ve never been more bullish on the broad opportunities ahead for every corner of finance to embrace crypto.

Here are seven areas where we see tremendous potential for growth:

1. Add user-managed wallets

Empower users with secure, self-custodial wallets that enable them to hold and interact with crypto natively.

Who’s this for? Fintechs and neobanks

Example: Robinhood Wallet attracted over 1 million users by offering this feature.

2. Enable crypto trading

Keep trades in-house to capture trading revenue and increase user retention.

Who’s this for? Fintechs and neobanks

Example: Revolut’s crypto integration drove a fivefold increase in activity.

3. Tokenize your assets

Tokenize your assets for 24/7 availability, partner transparency, regulatory compliance, and operational efficiency.

Who’s this for? Asset owners and managers

Example: Over 24 home equity lenders are tokenizing HELOC loans through Figure, saving basis points on every loan and bringing $500M/month in tokenized loans onchain.

4. Offer staking for passive yield

Allow users to stake assets like ETH and SOL for rewards while earning a share of staking commissions.

Who’s this for? Fintechs, exchanges, and neobanks

Example: Coinbase generated hundreds of millions from staking in 2024—around 15% of total revenue.

5. Integrate DeFi for lending

Tap into decentralized lending protocols to offer high-yield lending and borrowing options.

Who’s this for? Fintechs, banks, and asset managers

Example: MakerDAO, Aave, and Compound generated over $700 million in protocol revenue in 2024, with fintechs like SoFi and Lemonade exploring DeFi integrations for yield products.

6. Launch a stablecoin

Issue a fiat-backed stablecoin to monetize treasury interest and enable instant payments.

Who’s this for? Fintechs, payment processors, and global brands

Example: PayPal’s PYUSD generated over $200 million in annual revenue, positioning them as a stablecoin issuer at scale.

7. Launch your own blockchain

Create a Layer 2 chain to own blockspace, capture up to 100% of transaction flow as revenue, and control digital assets.

Who’s this for? Exchanges, large fintechs, and financial infra providers

Example: Coinbase’s Base chain expects over $200 million in annualized revenue within its first year, showing the power of owning your own infrastructure.

The cost of waiting

Delaying crypto adoption carries increasing risks:

Competitor momentum: Early movers are capturing market share and building moats.

Exponential user adoption: Once mainstream adoption hits, laggards will struggle to catch up.

New revenue leaving the table: Tether’s $13 billion in 2024 profits illustrate the missed opportunity... the missed opportunity for traditional financial players.

On the other hand, adopting crypto early unlocks billions in potential revenue, cost savings, and strategic advantage. Financial institutions that integrate crypto today will lead tomorrow’s financial landscape.

How Alchemy connects institutions to crypto

We are a complete, enterprise-grade web3 platform. We act as trusted partner to the financial industry at large, enabling companies that are interested in exploring crypto to seamlessly integrate blockchain capabilities while maintaining reliability, security, and compliance.

Why Alchemy?

We’re the trusted partner for institutions entering crypto, backed by scale, stability, and the infrastructure that powers the world’s leading crypto solutions.

Stability: $500M in raised capital, from top investors like a16z and Charles Schwab.

Experience: Leadership team brings decades of experience from Fortune 100 companies including Meta, Goldman Sachs, Stripe, Twilio, and more.

Proven scale: Powering crypto applications for over seven years with $150 billion in on-chain transactions and 99.99% uptime.

Compliance-ready: SOC 2 Type II certified with robust audit trails, transaction controls, and KYC/AML integrations.

Developer-friendly APIs: Enabling seamless integration of wallets, trading, staking, and more, with support from Alchemy’s expert team.

Alchemy bridges the gap between traditional finance and crypto, allowing institutions to build crypto offerings without technical complexity or operational risk.

The crypto era is here. With Alchemy as your partner, your institution can confidently embrace this opportunity, transforming customer experiences, unlocking new revenue streams, and future-proofing your business.

Ready to explore the future of finance? Contact Alchemy today to learn how we can tailor our crypto solutions to your needs.

Get tailored crypto solutions

Alchemy Newsletter

Be the first to know about releases

Sign up for our newsletter

Get the latest product updates and resources from Alchemy

By entering your email address, you agree to receive our marketing communications and product updates. You acknowledge that Alchemy processes the information we receive in accordance with our Privacy Notice. You can unsubscribe anytime.

Related articles

The Enterprise Stablecoin Guide

A practical guide to using stablecoins in enterprise payments—covering why legacy rails fail, which stablecoin types and chains to choose, privacy considerations, and when (not) to issue your own.

Deposit Tokens for Banks: A Practical Playbook

Major banks are quietly processing $10B+ daily in tokenized deposits. Here's how deposit tokens could capture $140 trillion by 2030 and a playbook to integrate for banks.

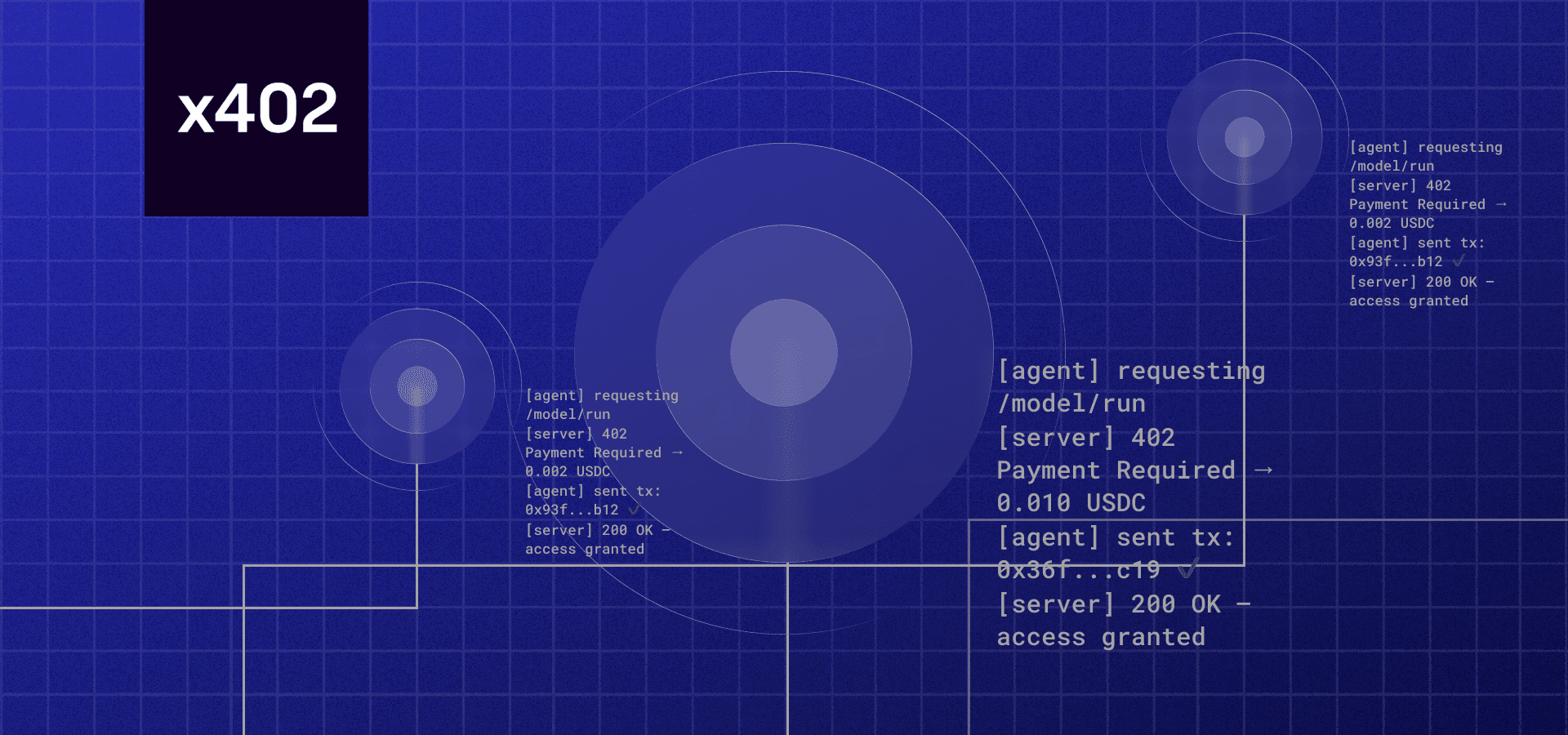

How x402 Brings Real-Time Crypto Payments to the Web

x402 revives the HTTP 402 code, so AI agents and apps can pay for API requests instantly using crypto: no accounts, no subscriptions, just seamless transactions.