Guide for Non-Crypto Natives on Choosing Smart Wallet Infrastructure

Written by Alchemy Team

Over 5.2 billion people use digital wallets today, but most have never touched crypto, and they shouldn't have to learn it to use your app. If you're building for everyday users, you need wallet infrastructure that hides the blockchain entirely.

Smart wallets abstract away the complexity, turning blockchain accounts into something that feels like any other login. No seed phrases. No gas fees. No "connect wallet" modals that scare away 90% of your users before they complete signup.

In this guide, we'll walk you through implementing wallet infrastructure that works for non-crypto users. We'll cover how to choose the right approach, what to look for in providers, and how to test before you ship.

Start by Defining Your Users

Before you pick an SDK, figure out who's actually going to use these wallets and why.

Build at least three personas. Maybe you've got a "mobile-first shopper" in their twenties who expects Face ID and instant checkout. Or a "DeFi-curious beginner" who needs guided onboarding. Or an "enterprise employee" who requires SSO integration. Write down demographics, technical comfort level, and primary motivations for each.

Set concrete goals. We recommend targeting account creation in under 30 seconds, zero seed phrase exposure, and a first-transaction success rate above 95%. Users now expect passkey-based or social/email-based auth and gasless transactions as baseline features.

Map your top three transaction flows. Are users tapping to pay in stores? Sending peer-to-peer transfers? Making in-app purchases? Document each flow and call out friction points. A user who has to buy ETH for gas before they can transact is a user who churns.

How Smart Wallets Actually Work

A smart wallet is a smart contract that can execute programmable logic, manage keys, and sponsor gas on behalf of users. Unlike traditional crypto wallets that make users guard 12-word seed phrases, smart wallets handle key management behind the scenes while users authenticate with methods they already know - Face ID, fingerprints, or email one-time passwords.

We've processed over 400 million smart wallet transactions , representing more than 85% of all smart wallet activity. The infrastructure has moved from experiment to production-ready.

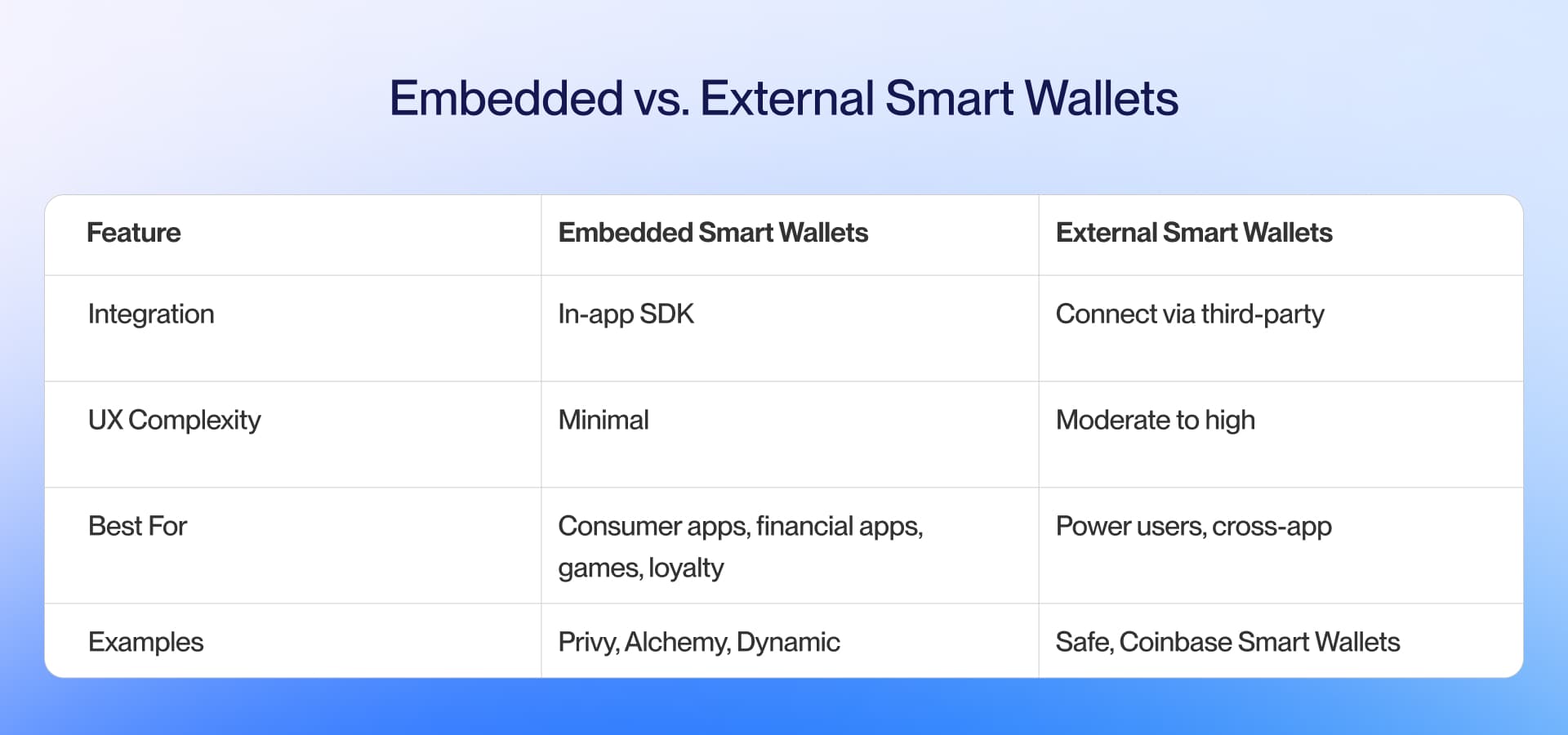

Embedded vs. External Smart Wallets

You've got two architectural choices for smart wallet implementation:

Embedded wallets integrate directly into your app through SDKs. Users never leave your interface or download separate apps. Everything happens in-app. This is what you want for consumer apps, games, DeFi, and loyalty programs where you control the full experience.

External smart wallets are third-party branded wallets that users bring to your app like Coinbase Smart Wallet. You can embed the connection experience in your app, but users manage their assets through the third party's interface. They can use the same wallet across multiple apps, giving them a consistent experience and full control over their keys.

The UX Breakthrough: Passkeys and Gas Sponsorship

Two technologies have made smart wallets viable for mainstream users:

Passkey authentication replaces seed phrases with the same biometric security users trust for banking apps. The wallet provider generates and stores keys in secure enclaves while users authenticate with a fingerprint or face scan. Apple, Google, and Microsoft all support passkeys natively, which means you're building on top of OS-level security primitives.

Gas sponsorship means you pay transaction fees instead of your users. They never need to buy ETH, understand gas prices, or worry about failed transactions. Account abstraction frameworks—specifically ERC-4337—make this standard. A paymaster contract pays fees on behalf of users, and you can set policies like "sponsor the first 10 transactions" or "sponsor transactions under $100."

Together, these eliminate the two biggest barriers: complicated authentication and upfront token requirements.

What to Look for in a Provider

Three things determine whether a provider can scale with you: security posture, gas sponsorship implementation, and developer experience.

Security, Audits, and Key Isolation

Review third-party audit reports from firms like Quantstamp or OpenZeppelin. Check for hardware-backed key isolation—whether user keys are stored separately from provider infrastructure. Look for MFA options and compliance certifications like SOC 2.

Key isolation ensures that even if a provider gets compromised, user keys remain safe. Ask providers to walk you through their key management architecture in detail. If they can't explain it clearly, that's a red flag.

Gas Sponsorship and Account Abstraction

Providers implement account abstraction through paymasters: smart contracts that pay fees on users' behalf.

Build a comparison matrix:

Does the provider sponsor gas? On which chains?

Can you set custom policies? (First N transactions only? Transactions under a certain value?)

What happens when users exhaust their gas allowance?

How do you top up your paymaster balance?

Some providers let you sponsor gas conditionally based on transaction type or user behavior. This flexibility matters when you're trying to balance user experience with cost control.

API Design, Multi-Chain Support, and Pricing

Request concrete API examples. Can you create a wallet in a single API call? How many lines of code to sign and send a transaction? Developer experience determines your time-to-market.

If you want to see the full implementation, we've built a pre-configured quickstart repo that includes the entire flow—authentication, wallet creation, and transactions. You can clone it and have a working demo running in minutes.

Require pricing transparency. Some providers charge flat monthly fees, others use usage-based pricing. Many offer free tiers for early-stage projects. Multi-chain support is also essential to give your users the widest access to liquidity.

Ask about rate limits, SLA guarantees, and support response times. These operational details matter more than feature checklists once you're in production.

Test Before You Ship

Prototype in a controlled environment before going live. Production is expensive to debug.

Set Up a Sandbox

Provision a testnet environment—Sepolia for Ethereum, Base Sepolia for Base. Configure sandbox API keys from your provider. Write automated scripts to simulate 1,000 concurrent signups and measure response times under load.

Testing at scale reveals bottlenecks invisible in manual testing. A provider that handles ten signups smoothly may buckle under hundreds. We learned this the hard way.

Test Critical Flows and Recovery Scenarios

Enumerate test cases:

Successful signup

Failed email verification

Lost device recovery

Passkey reset

Gas-sponsored transaction failures

Network congestion scenarios

Define clear recovery options. Social recovery through trusted contacts is user-friendly but requires users to designate contacts. Custodial escrow is simple but requires trusting your provider. Hardware backup keys are secure but users can lose them.

Each recovery method trades convenience for security. Choose based on your users' technical sophistication and risk tolerance. For a mainstream consumer app, we'd lean toward custodial escrow with optional social recovery. For a DeFi protocol, full user control matters more.

Measure What Matters

Set target thresholds:

API response times under 200 milliseconds

Error rates below 1%

User drop-off rates under 5% at the "create wallet" step

NFC contactless payments typically complete in under a second. If your wallet can't match that speed for tap-to-pay use cases, users will notice. They'll blame your app, not the blockchain.

Track these metrics continuously. A sudden spike in API latency or error rates signals infrastructure problems before they become user complaints.

Launch, Monitor, and Iterate

Production is where theory meets reality. Real users stress systems in ways tests never anticipate.

Real-Time Monitoring and Security

Integrate dashboards like Grafana or CloudWatch to track active users, gas-sponsored transaction volume, and anomaly detection. Set alerts for unusual patterns—spikes in failed transactions, abnormal geographic distribution, or rapid account creation.

AI-driven fraud detection catches patterns humans miss. The Treasury's success using machine learning to identify fraud demonstrates its effectiveness at scale. You need similar capabilities.

Recovery and Compliance

Document a step-by-step recovery flow: identity verification, recovery key issuance, and wallet re-linking. Balance compliance with privacy—implement KYC/AML verification where required without unnecessarily collecting user data.

Many jurisdictions now require KYC for financial services. Work with specialized providers like Persona or Onfido who handle identity verification while keeping you compliant. Don't build this yourself unless you have a dedicated compliance team.

Scale Through Iteration

Schedule quarterly reviews to evaluate new features. Voice-activated payments grew 25% in 2023 and continue gaining traction. Run A/B tests on UI elements—does a biometric prompt convert better than a passkey option? Which onboarding flow has the lowest drop-off?

User behavior reveals what works. Let data guide your roadmap, not assumptions about what users "should" want.

Common Questions We Hear

How does a smart wallet work without seed phrases?

Smart wallets use passkey-based authentication or custodial key management. The provider generates and securely manages keys in hardware security modules while users sign in with Face ID, fingerprints, or email codes. The seed phrase never exists in a form users can lose or leak.

What is a gasless transaction?

A gasless transaction is one where the wallet provider pays blockchain fees on your behalf. This eliminates the need for users to acquire native tokens before transacting—the biggest barrier to mainstream adoption. Under the hood, a paymaster contract sponsors the gas fee and you reimburse the provider based on your pricing plan.

How do I stay compliant with KYC/AML requirements?

Integrate a KYC provider that verifies user identity at wallet creation and monitors transaction patterns continuously. Most embedded wallet providers support pluggable KYC integrations. This ensures compliance without requiring you to build identity verification infrastructure or handle sensitive user data directly.

What happens if a user loses their device?

Recovery methods include social recovery through trusted contacts, custodial escrow with your provider, or secondary passkeys stored on other devices. Each option is tied to verified user identity. For consumer apps, we recommend custodial escrow as the primary recovery method with social recovery as a backup—it provides the best balance of security and usability.

Should I use an embedded wallet or an external smart wallet?

Use embedded wallets for seamless in-app experiences with minimal user friction—ideal for consumer apps, games, DeFi, and loyalty programs. Use external smart wallets when users need cross-app portability, full control over their keys, or advanced DeFi features. Most apps targeting mainstream users should start with embedded wallets.

Next Steps

If you're building wallet infrastructure for non-crypto users, start by defining your personas and transaction flows. Then prototype with a few providers to see what works best for your use case.

We built Smart Wallets to solve these problems. It handles authentication, gas sponsorship, and account abstraction through a single SDK that works across chains. You can integrate it in an afternoon and ship wallet infrastructure that feels like any other login system.

Check out our documentation to get started, or reach out if you want to discuss your specific requirements.

Related overviews

ERC-4337 enables smart contract wallets on Ethereum without requiring any consensus-layer protocol changes.

Learn web3 authentication basics and how to build modern flows onchain with email and social login.

Deep dive into MPC wallets and modern crypto security through distributed private key technology.