How to Use a Decentralized Exchange on Solana

Written by Aguchukwu Emmanuel Ebube

Raydium is an Automated market maker(AMM) decentralized exchange (DEX) platform built on Solana, that allows digital assets to be traded automatically using liquidity pools instead of the traditional market exchange system.

Raydium offers fast and cheaper transactions compared to other decentralized exchange platforms. This article will take you through a step-by-step process on how to trade tokens on Raydium.

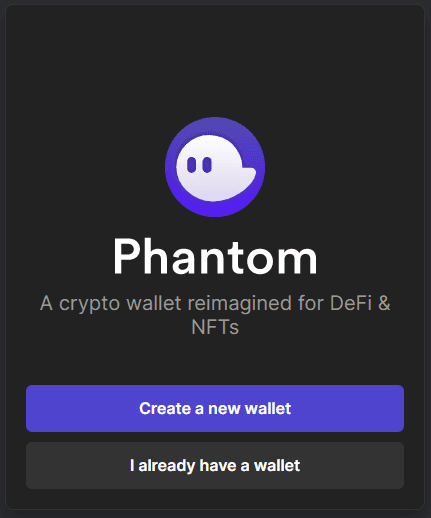

1. Download a Solana Wallet

Phantom is the most used Solana wallet, and it's the wallet this tutorial uses to trade tokens on Raydium.

Go to Phantom

Download and install Phantom as a browser extension (Chrome, firefox, brave, and edge)

Create a new wallet and note down your secret recovery phrase

Note: never share your recovery phrase with anyone because losing it means losing access to all your funds.

2. Fund your Solana Wallet

Open your wallet and click the dropdown button

Copy your wallet address

Go to your favorite crypto exchange platform (e.g Coinbase)

Buy Solana and any other Solana ecosystem tokens you want to trade

Withdraw them to your Phantom wallet address

Note: make sure the exchange supports Solana token withdraws. Some exchanges allow buying and selling Solana tokens, but do not offer withdraw functionality.

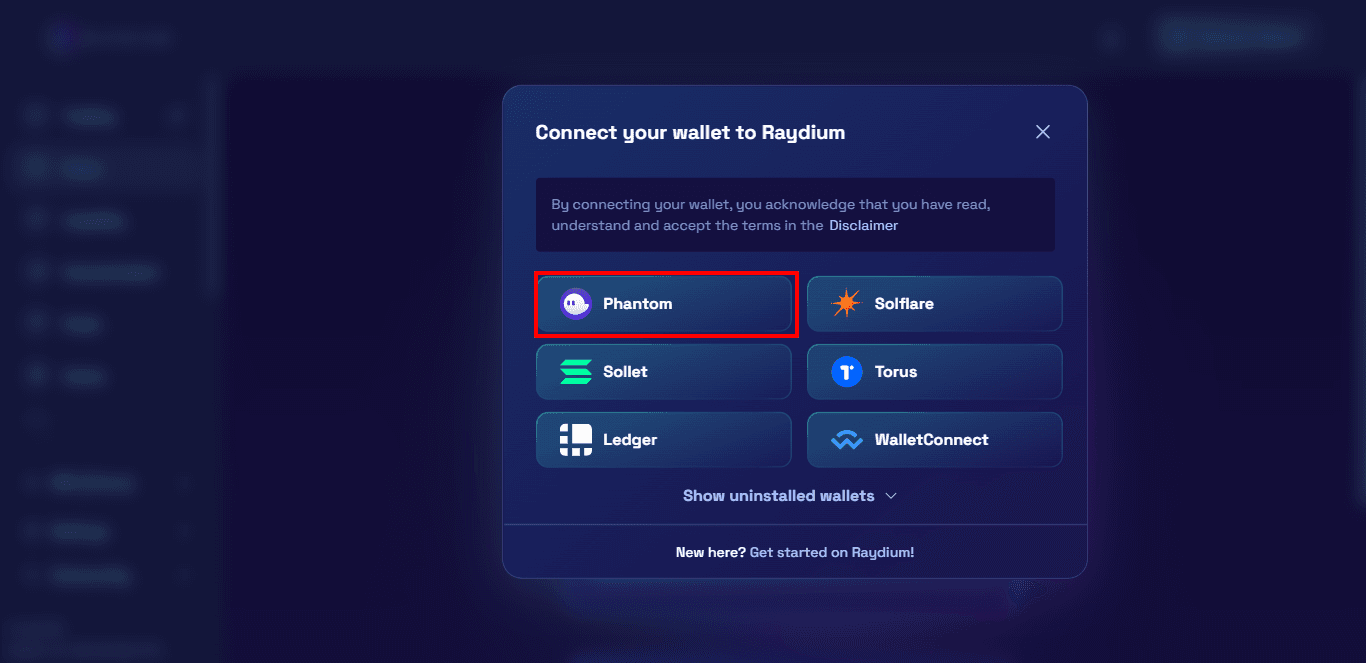

3. Connect your Wallet

Go to Raydium

Click on the "Launch App" button to access the DEX interface

Click on the "Connect" button to connect your wallet

Select Phantom

Allow Raydium to access your wallet

Click on connect

4. Select the Assets you Want to Trade

Select the desired token you wish to swap from (e.g. SOL)

Select the token you wish to swap to (E.g. USDC)

Specify the amount of tokens you want to swap

Once you choose the amount of tokens you want to swap, the amount of tokens you will receive of your new token will automatically be calculated.

a. Confirm your Swap Settings

Before you confirm your transaction, it is a good decision to check the info section to understand more details about the transaction. These trade settings become more important for large transactions.

Here are explanations of the swap settings:

Minimum Received - the minimum amount of tokens you will receive from the trade

Slippage Tolerance -the difference between your estimated price and the execution price

Price Impact - the difference between market price and estimated price (the impact is larger for large trades)

If prices are volatile, transactions with low slippage might not get confirmed. However, if slippage tolerance is high, you may receive less tokens for your swap because the market price changed between your original estimate and the price during trade execution.

5. Swap Tokens on Raydium

Now that your settings are reviewed, it's time to submit the transaction.

Click on the Swap button

Click the transaction link to view it on a Solana block explorer like Solscan

Confrim your assets were swapped once the transaction is confirmed on the blockchain

Note: the swap button only shows up when you have a sufficient balance to process the transaction, and it might take a few seconds to be confirmed.

Related overviews

DeFi AI agents are here. Build intelligent agents that automate, reason, and execute in DeFi using Alchemy.

Off-chain attacks caused 80.4% of 2024 crypto losses. Smart wallets offer better security, here's how.

Learn About Ethereum's Liquid Staking Token Ecosystem And The Top Players

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.