How to Use a Decentralized Lending Platform on Ethereum

Written by Aguchukwu Emmanuel Ebube

Aave is an open-source, DeFi lending platform that allows users to lend and borrow crypto using a peer-to-pool strategy. Aave users interact with smart contracts to lend and borrow digital assets from a liquidity pool, and in return they either earn or pay interest on the loaned or borrowed assets.

Aave allows the use of different blockchain protocols called markets, which includes layer 2 blockchains. Users can lend crypto and earn profit for the duration of the loan. Currently, Aave has over $6 billion worth of assets locked in its protocol. This article demonstrates how to lend on Aave.

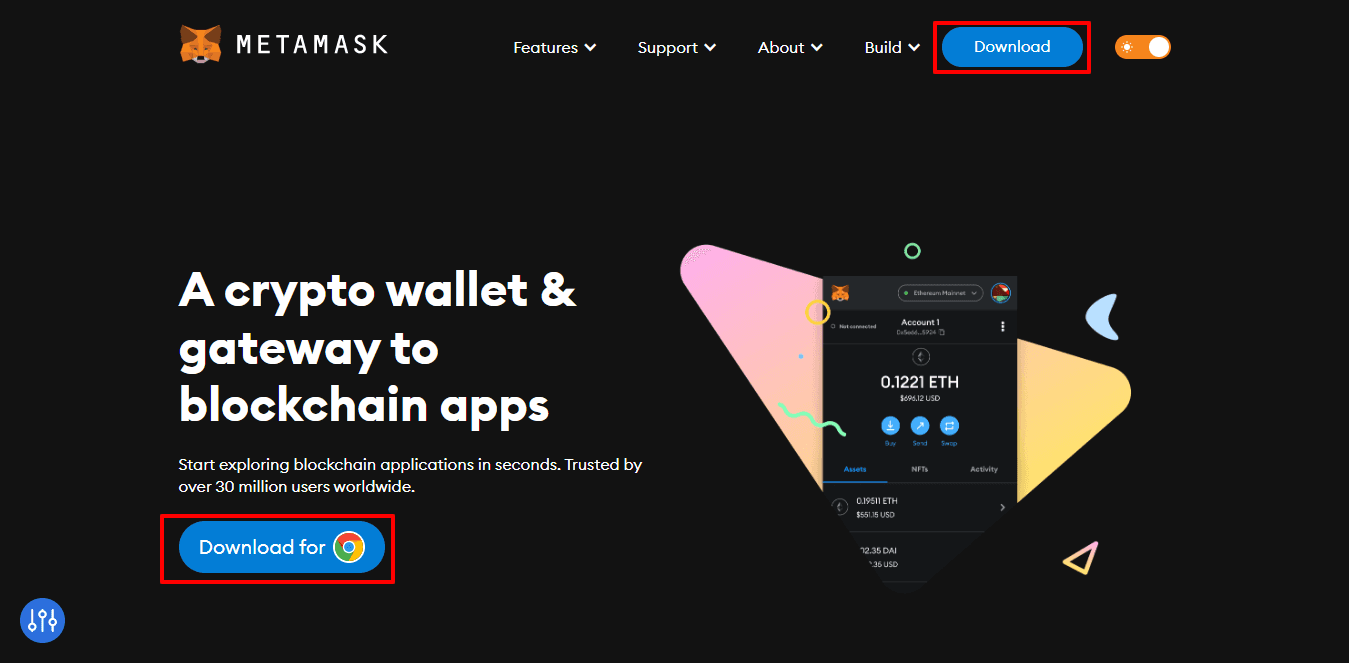

1. Download and Install MetaMask

Go to MetaMask

Download and install MetaMask as a browser extension(Chrome, firefox, brave, edge, and opera) for PCs

Create an account

Save your secret recovery phrase

Note: Never share your recovery phrase with anyone. Losing your seed phrase means losing access to all your funds.

2. Fund your MetaMask Wallet

Copy your MetaMask address (click on your account address to copy it)

Go to a crypto exchange (e.g. Coinbase)

Buy some Ethereum or any asset you want to lend on Aave

Withdraw Ethereum and any other ERC20 tokens you want to lend on Aave to your wallet address

Note: you will need some amount of ETH to pay for gas fees

3. Connect Your MetaMask Wallet to Aave

Go to Aave

Click on the launch app button to access the Aave user interface

Click on the connect button to connect your wallet

Select browser wallet to trigger your MetaMask wallet to open

Enter your password or confirm your desire to connect to Aave

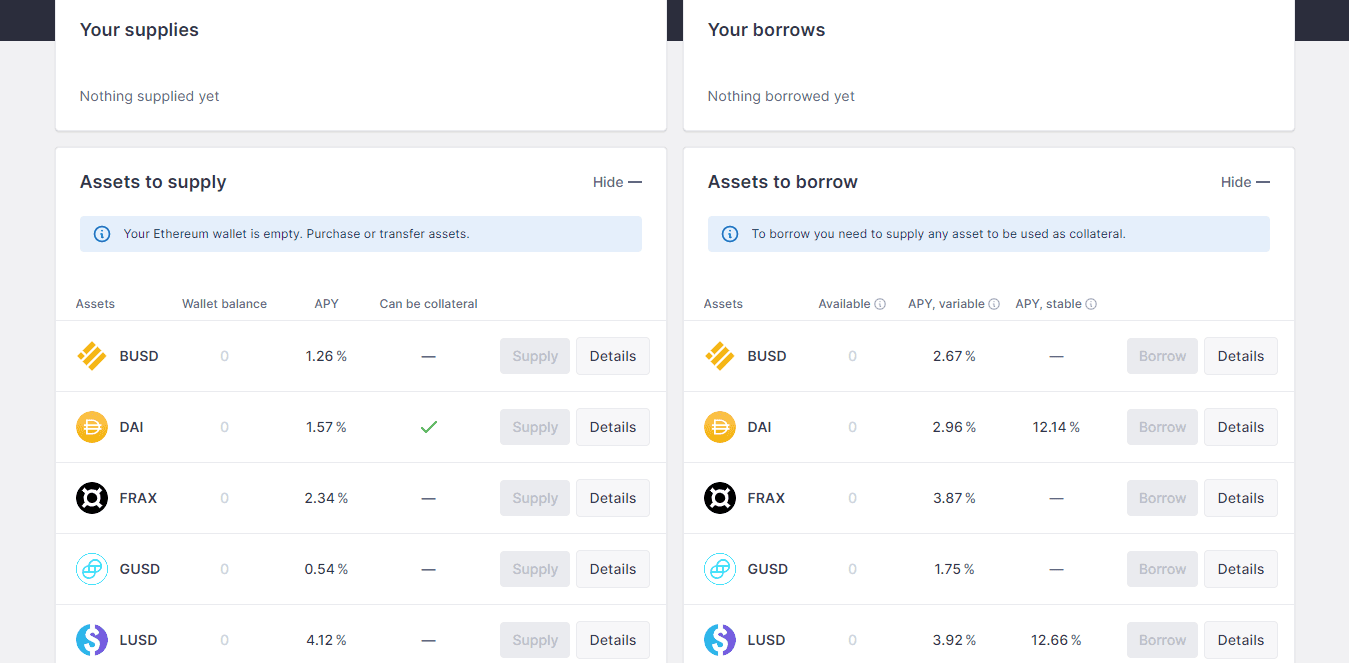

4. Choose the Token You Want to Lend or Borrow

Aave has different markets for lending and borrowing crypto. By default the Ethereum version 2 market is selected. The version 3 markets are layer 2 blockchains that provide faster and cheaper transactions. For this tutorial, we will use the Ethereum version 2 market.

Click on the drop-down button

Select the Ethereum version 2 market if it isn't already selected

From the interface, you can see the assets you can supply as well as the ones you can borrow

Note: that the supply button only becomes active when you have the required asset to lend.

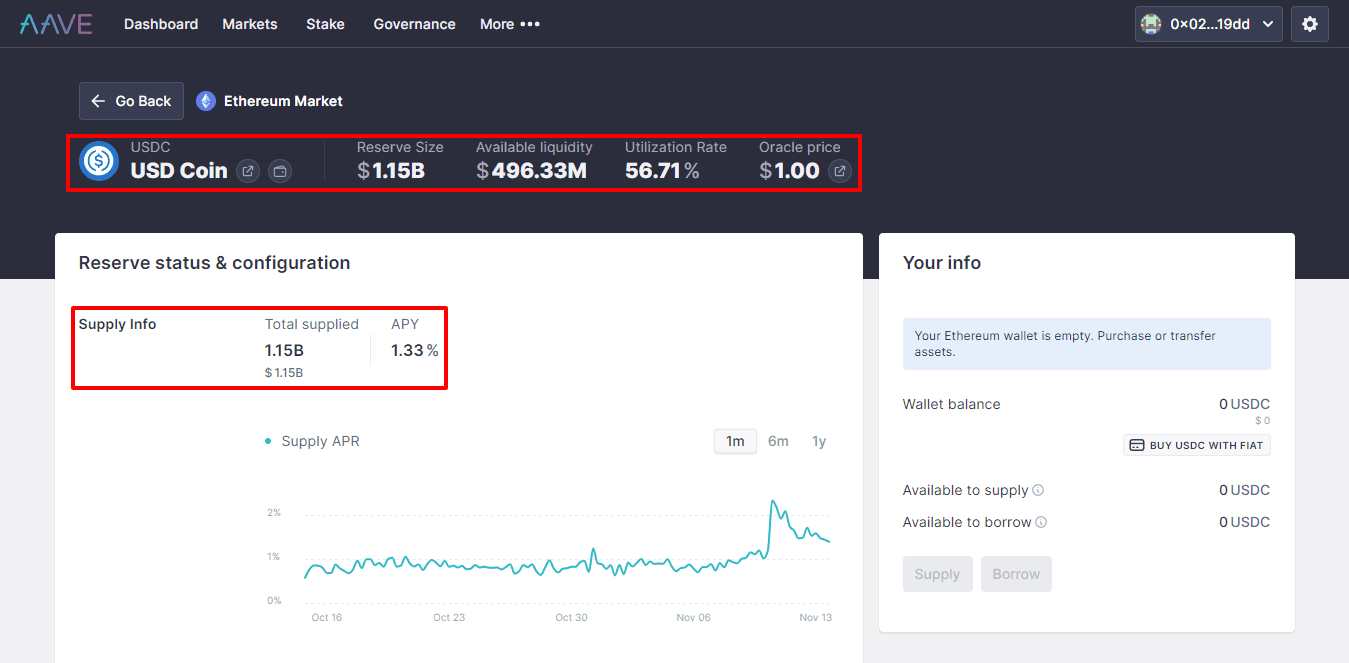

Here is what different labels on the Aave UI mean:

Reserve size - the total amount of assets that have been supplied to the protocol

Available liquidity - the amount of assets available that have not been borrowed

Utilization rate - the amount of assets that have been borrowed (the higher the utilization rate, the higher the APY)

APY - the Annual Percentage Yield of the specified asset (i.e. the profit you earn by lending your asset based on supply and demand)

5. Lend ERC20 Tokens on Aave

Now that your wallet is connected and you know which token you want to lend, it's time to submit a transaction.

Select the asset you want to lend (i.e. supply)

Click on the supply button.

Specify the amount of asset you want to lend

Approve the transaction and pay the gas fees on your MetaMask wallet

The transaction might take a few seconds to a few minutes to go through. After the transaction has been confirmed, you can see how much you’re lending on Aave.

Related overviews

DeFi AI agents are here. Build intelligent agents that automate, reason, and execute in DeFi using Alchemy.

Off-chain attacks caused 80.4% of 2024 crypto losses. Smart wallets offer better security, here's how.

Learn About Ethereum's Liquid Staking Token Ecosystem And The Top Players

Build blockchain magic

Alchemy combines the most powerful web3 developer products and tools with resources, community and legendary support.